Guidance with Passion

Welcome to Matthews Senior Benefits, where we understand the intricate challenges that accompany aging and the vast, bewildering landscape of healthcare. We’re committed to standing by your side as a reliable partner, guiding you toward the optimal solutions for your unique healthcare needs.

Our seasoned team offers unwavering support, personalized assistance, and expert guidance. From unraveling the nuances of Medicare plans to comprehending supplemental coverage and planning for end-of-life expenses, our mission is to empower you to make well-informed choices and secure the coverage you rightfully deserve.

Thriving Senior Care

At Matthews Senior Benefits, you can embark on your senior years with the assurance that you’ll receive the care and assistance essential to thriving during this remarkable phase of life

Testimonials

Throughout our collaboration, we have witnessed Matthews Senior Benefits dedication to understand our business needs and addressing them with tailored solutions. Their collaborative approach and open lines of communication have fostered a strong and mutually beneficial working relationship.

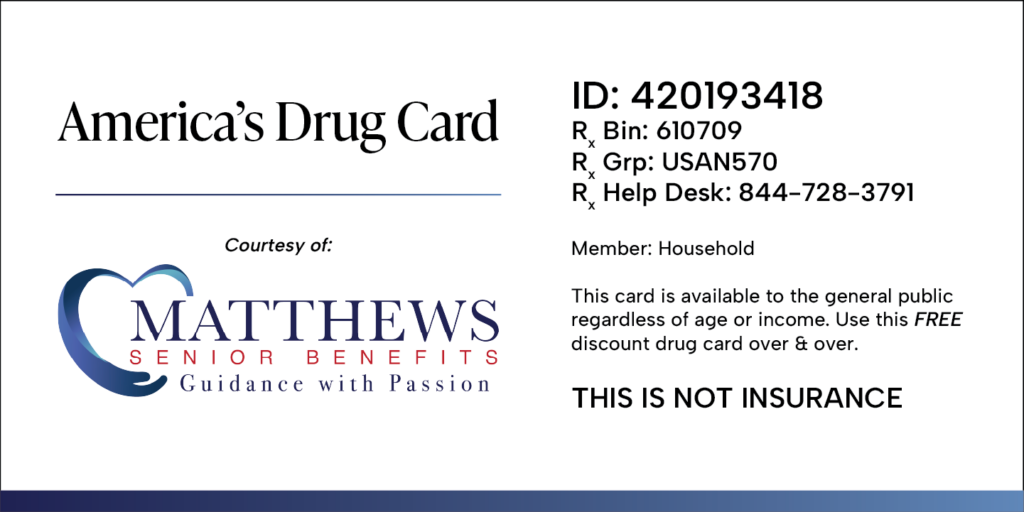

America's Drug Card

Present this card along with your prescription to receive, on average, a discount of 15% on brand-name and 55% on generic drugs.

This card is available to the general public regardless of age or income. Use this FREE discount drug card over and over.

*THIS IS NOT INSURANCE

Click the button below to download & print.

Health when Turning 65

Turning 65 is an important milestone, and at Matthews Senior Benefits, we understand the complexities of healthcare options at this stage of life. Our dedicated team provides guidance and support as you navigate through various healthcare coverage choices, including Medicare.

We’ll help you understand the options available and assist you in selecting a plan that fits your specific needs and budget.

Medicare Advantage

Matthews Senior Benefits partners with leading insurance providers to offer a comprehensive range of Medicare Advantage plans. Our knowledgeable advisors will walk you through benefits, costs, and network options that come with each plan.

With our expertise, you can choose the Medicare Advantage plan that best suits your healthcare requirements and preferences.

Medicare Supplements

Medicare covers a lot, but it doesn’t mean you’ll walk away from your medical services without paying anything. You still have to cover certain costs on your own, such as copayments, coinsurance, and deductibles. That is, unless you get a Medicare Supplement plan, also known as Medigap. Medicare Supplement plans are indispensable because they cover thousands of dollars on your behalf.

Matthews Senior Benefits provides a broad and diverse selection of Medigap plans from top-tier insurance carriers. Our seasoned team will explain your options so you can make your decision with clarity and confidence. We guarantee that you’ll have the optimal Medicare Supplement plan that addresses your specific healthcare needs.

Hospital Indemnity

Hospital stays are unpredictable sources of financial distress. This is precisely why Matthews Senior Benefits offers Hospital Indemnity plans, as they’re designed to protect you against the massive debt you may incur after hospitalization. Our plans will pay you a cash benefit in this unfortunate scenario, with no strings attached as to how you can spend the money.

Final Expense

Our debts outlive us, and unfortunately, they get passed down to the ones we care about the most. That includes, but isn’t limited to, funeral and burial costs, hospital expenses, outstanding mortgage balances, credit card debts, and unpaid loans.

The good news is that Matthews Senior Benefits provides Final Expense Insurance, which provides your loved ones with a cash benefit to cover these burdensome costs so they don’t have to.

The odyssey of comprehending healthcare options, decoding Medicare plans, and securing the coverage you need is simplified with Matthews Senior Benefits. Our team is always one call away to address your questions and concerns, and empower you to make well-informed decisions at your convenience.

Contact us today to learn more about how Matthews Senior Benefits can help you navigate healthcare options, understand Medicare plans, and secure the coverage you need. Our team is dedicated to supporting you every step of the way.

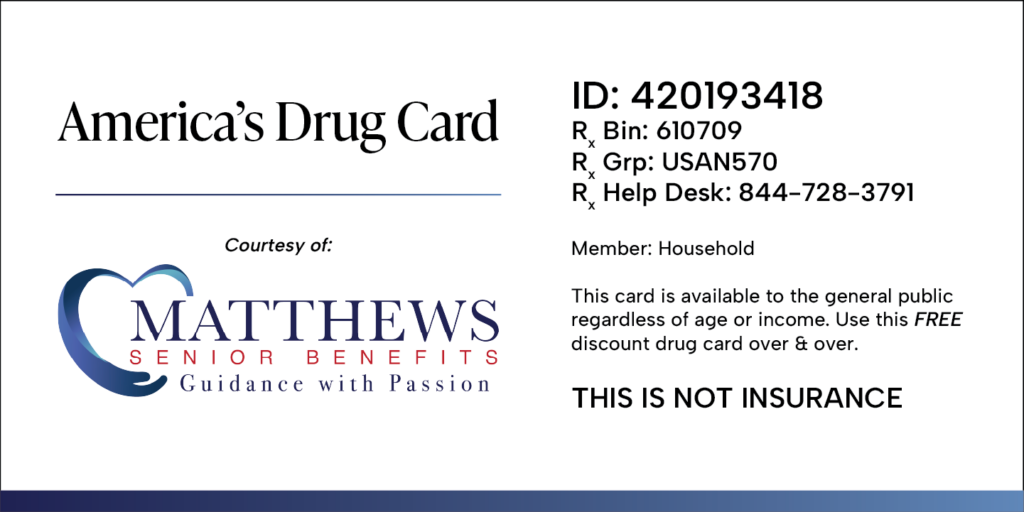

America's Drug Card

Present this card along with your prescription to receive, on average, a discount of 15% on brand-name and 55% on generic drugs.

This card is available to the general public regardless of age or income. Use this FREE discount drug card over and over.

*THIS IS NOT INSURANCE

Click the button below to download & print.

Health when Turning 65

Turning 65 is an important milestone, and at Matthews Senior Benefits, we understand the complexities of healthcare options at this stage of life. Our dedicated team provides guidance and support as you navigate through various healthcare coverage choices, including Medicare.

We’ll help you understand the options available and assist you in selecting a plan that fits your specific needs and budget.

Medicare Advantage

Matthews Senior Benefits partners with leading insurance providers to offer a comprehensive range of Medicare Advantage plans. Our knowledgeable advisors will walk you through benefits, costs, and network options that come with each plan.

With our expertise, you can choose the Medicare Advantage plan that best suits your healthcare requirements and preferences.

Medicare Supplements

Medicare covers a lot, but it doesn’t mean you’ll walk away from your medical services without paying anything. You still have to cover certain costs on your own, such as copayments, coinsurance, and deductibles. That is, unless you get a Medicare Supplement plan, also known as Medigap. Medicare Supplement plans are indispensable because they cover thousands of dollars on your behalf.

Matthews Senior Benefits provides a broad and diverse selection of Medigap plans from top-tier insurance carriers. Our seasoned team will explain your options so you can make your decision with clarity and confidence. We guarantee that you’ll have the optimal Medicare Supplement plan that addresses your specific healthcare needs.

Hospital Indemnity

Hospital stays are unpredictable sources of financial distress. This is precisely why Matthews Senior Benefits offers Hospital Indemnity plans, as they’re designed to protect you against the massive debt you may incur after hospitalization. Our plans will pay you a cash benefit in this unfortunate scenario, with no strings attached as to how you can spend the money.

Final Expense

Our debts outlive us, and unfortunately, they get passed down to the ones we care about the most. That includes, but isn’t limited to, funeral and burial costs, hospital expenses, outstanding mortgage balances, credit card debts, and unpaid loans.

The good news is that Matthews Senior Benefits provides Final Expense Insurance, which provides your loved ones with a cash benefit to cover these burdensome costs so they don’t have to.

The odyssey of comprehending healthcare options, decoding Medicare plans, and securing the coverage you need is simplified with Matthews Senior Benefits. Our team is always one call away to address your questions and concerns, and empower you to make well-informed decisions at your convenience.

Contact us today to learn more about how Matthews Senior Benefits can help you navigate healthcare options, understand Medicare plans, and secure the coverage you need. Our team is dedicated to supporting you every step of the way.

Contact Us

Matthews Senior Benefits is here to support you in your efforts to lead a healthy, happy, and prosperous life.

To schedule a free quote or consultation, please contact us today!